The famous author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, has made some gloomy predictions about the economy and the future of cryptocurrency. Besides warning that we are in the biggest bubble in world history, Kiyosaki has predicted that the government will seize all cryptocurrencies.

Robert Kiyosaki Warns of the Biggest Bubble, Depression, Hyperinflation

The author of Rich Dad Poor Dad, Robert Kiyosaki, has made several gloomy predictions and bleak warnings over the past couple of days.

Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

On Tuesday, he tweeted to his 1.8 million followers, “Do you have a plan B?”

The famous author proceeded to warn that we are in the biggest bubble in world history, citing bubbles in stocks, real estate, commodities, and oil. As far as the future outlook, he warned about hyperinflation and a depression. Kiyosaki tweeted:

We are in biggest bubble in world history. Bubbles in stocks, real estate, commodities & oil … Future? possible depression with hyperinflation.

He then explained that his plan B is to “be an entrepreneur.” Specifically, “stay out of [the] stock market, create own assets, [and] use debt as $,” he wrote.

This is not the first time that the famous author warned about a depression. In December last year, he similarly predicted that a depression is coming.

Kiyosaki often tweeted blaming President Joe Biden, his administration, and the Federal Reserve for high inflation and destroying the U.S. dollar. Last week, the Rich Dad Poor Dad author advised investors how to profit from inflation and invest like a capitalist.

Kiyosaki Warns About Government Seizing All Cryptocurrencies, Absorbing Into ‘Fed Crypto’

Until Tuesday, Kiyosaki had been bullish on bitcoin. He often recommended buying gold, silver, and bitcoin as a hedge against inflation

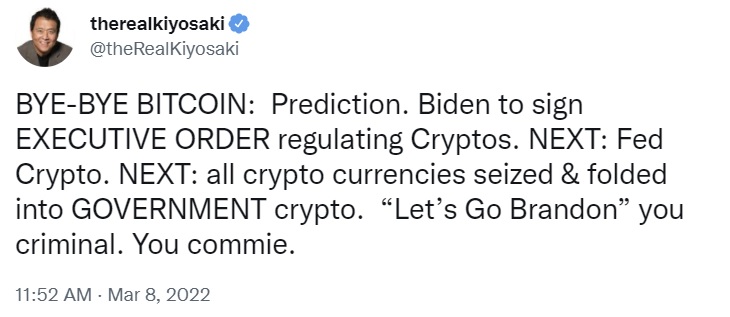

However, he tweeted Tuesday morning that he expects the U.S. government to seize all cryptocurrencies.

He explained that after President Biden signed an executive order regulating cryptocurrencies, the next step would be to launch a “Fed crypto.” After that, he believes that all cryptocurrencies will be seized and folded into the government crypto. “Bye-bye bitcoin,” he wrote.

Kiyosaki’s crypto prediction has been heavily criticized in the crypto community, with many people stressing that he should have waited to see what’s actually in the executive order before speculating recklessly on it.

Many people think that President Biden’s executive order is very positive for the crypto industry. Jerry Brito, executive director of D.C.-based think tank Coin Center, commented:

The message I take from this executive order is that the federal government sees cryptocurrency as a legitimate, serious, and important part of the economy and society.

What do you think about Robert Kiyosaki’s warnings? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer